Contents

Research Project Samples for Students: Research is a process of intellectual finding that has the potential to transform knowledge and understanding of natural and social phenomena. It is a process of inquiry and investigation with 4 main characteristics:

- It is a process

- It is systematic,

- It is methodical

- It is ethical.

Below are research project proposal example

Research Proposal Format

Preliminary pages

-

The Cover Page

It helps to identify the research topic, the researcher, the association, and the date of the research.

Example of a Research Cover Page {NB: Cover page outline may vary}

|

Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange Alice Cooper A research Proposal Submitted to the Department of Economics, Accounting and Finance, in the School of Business in Partial Fulfillment of the Requirements for the award of Bachelor Degree in Economics from XXX University |

Read: Research Topics on Mental Health

-

The Declaration Page

It aims at authenticating the originality of the research work and adherence to ethical expectations.

Example of The Declaration Page

|

DECLARATION This research is my original work and has not been presented for a degree or diploma in any other university. Signed: _____________________________ Alice Cooper Reg 45254/2017/ED Date_______________________ This research proposal has been submitted for examination with my approval as the University Supervisor. Signed: ________________________________ Professor Mishael Pine Date____________________ |

-

Acknowledgement page

Used to acknowledge various parties that may in one or another contributed to the development of the proposal.

-

Dedication page(Optional)

Read: Criminal Justice Research Proposal Topics

-

Abstract

The abstract allows one to elaborate upon each major aspect of the paper and helps readers decide whether they want to read the rest of the paper. In other words, it is a short statement on background of the problem, objective, brief outline of methodology etc.

NB: The recommended number of pages for abstract is one to one and half pages

-

Table of contents

A table of Contents provides a road-map to the research work.

It is used to facilitate easy navigation through the research proposal and final research project.

Word processing tools have inbuilt ability of automatically generating not only the table of contents but also the list of tables and the list of figures used in the research document.

-

Acronyms and abbreviations

The page outlines the important abbreviations used in the research document.

The acronyms and abbreviations are specified in an alphabetic order like in the specimen provided below.

An acronym is an abbreviation formed from initial letters of other words or name of something e.g. SE : Security Exchange

-

Operational Definition of terms

This should focus on the key terms relating to the variables and other concepts of the study. They should be arranged in alphabetic order e.g.

Read: Cyber Security Research Topics

Chapter One: Introduction

1.1. Background to the Study

The background presents the reader to the variables, the extant literature and the basis of the research problem. It outlines the understanding and genesis of the problem, as well as showing specific gaps.

1.2. Statement of the Problem

This section follows from the background. It states what the problem is, why it is a problem and how it is a research problem

Example of Statement of The Problem in Research

| Research Title “Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange”.

Tax efficiency is an important objective of all organizations. Businesses always aim to maximize shareholder value and this inevitably involves minimizing cash outflows arising from payment of tax (Pandey, 2012). Despite the critical importance of tax minimization, it is still not clear whether and how business size affects tax efficiency. This lack of clarity arises from the seeming conflict in both theoretical and empirical literature as to the effect of business size on tax efficiency. From a theoretical angle, there are two sets of conflicting theories that try to explain how business size affects tax efficiency. The first school of thought propagated by corporate governance expectations of Doyle (2007) indicates that size has a positive effect on tax efficiency and that the larger the firm size, the greater the tax efficiency. On the extreme opposing theoretical angle is the X-efficiency theory of Leibenstein (1966) concludes that size is inversely related to tax efficiencies arises from diseconomies of scale. To add onto the confusion, extant empirical literature arrives at conflicting findings with respect to the effect of firm size on tax efficiency. Sharpe (2017) while studying the effect of business size based on market share on tax efficiency found that size has a positive effect on tax efficiency among public manufacturing firms in Bulgaria. Similar findings have been reported by Sloan (2016) in Malaysia using assets as a measure of size; O’Hara (2014) using employee base as a measure of bank size in Nigeria and Francis et al. (2016) using market share to measure firm size in Argentina. Contradicting findings indicate that firm size has a negative effect on tax efficiency. A Study by Easley (2013) who used market capitalization to measure firm size of listed firm at Johannesburg stock Exchange found that large capitalization firms are less tax efficient when compared to their small size counterparts. These findings are supported by Chen (2017) in South Korea for insurance firms with size measured by market share and Gray (2016) among public Banks in Botswana with size measured using the number of employees. Drawing from the confounding literature, it is not clear how firm size as indicated by market capitalization, asset base and employee base affects tax compliance among firms listed at NSE |

Read: Research Proposal Topics in Education

1.3. Research Objectives

The general objective reflects the title of the research project while the specific objectives relate to the individual independent variables and their relationship with the dependent variable

1.3.1. General Objective

| Examples of Research Objectives in A Research Proposal

{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} The General objective of this study is to establish the effect of firm size on tax efficiency of firms listed at the Nairobi Securities Exchange |

1.3.2. Specific Objectives

| Example of Specific Objectives in Research

{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} To evaluate the effect of firm asset base on tax efficiency of firms listed at the Securities Exchange. To establish the effect of firm employee base on tax efficiency of firms listed at the Securities Exchange. To assess the effect of firm market capitalization on tax efficiency of firms listed at the Securities Exchange. |

1.4 Research Hypotheses

The hypotheses are statistically testable statements to help resolve the research questions or meet the research specific objectives.

They can be stated as null (falsified form of hypotheses) or alternative (hypotheses to be held as true if the null is rejected).

Read: Technology Research Topics

| Example of Research Hypotheses in Research

{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} Example of Hypothesis in Research Proposal H01 Firm asset base does not have any significant effect on tax efficiency of firms listed at the Securities Exchange H02 Firm employee base does not have any significant effect on tax efficiency of firms listed at the Securities Exchange H03 Firm market capitalization does not have any significant effect on tax efficiency of firms listed at the Securities Exchange. |

1.5 Research Questions

They can be used in place of the research hypotheses.

| Example of Research Questions in Research Proposal

The research questions of the study are specified as

|

Read: List of Research Topics for Nursing Students

1.5. Scope of the Study

This section offers an insight onto the scope with respect to:

- The context of the study

- The time period for the study

- The population of the study

The researcher must be careful to defend the choice of the scope by relying on existing literature

| Example of Scope of the Study in Research Proposal

{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} This study aims to cover all the listed companies on the XXX Stock Exchange as at 31.12.2020. This scope is justifiable on the basis that listed companies are under an obligation to publish their financial information. Accordingly, there will be adequate data for analysis of tax efficiency. In addition, it is only listed companies that one can obtain market capitalization from their trading data at XSE. Further the study will cover a five-year period running from January 2015 to December 2020. The period is considered long enough to establish cross sectional and time series variations important in such studies as stipulated by Garman (2012). From the theoretical aspect the study will focus on X-efficieny theory and corporate governance theories. Finally, from a conceptual point of view, the study will use firm asset base, employee base and market capitalization to measure firm size. These are aspects readily measurable from available secondary data (Fama, 2008). |

1.6. Justification of the Study

The justification of the study offers the benefits of the study to the various stakeholders as well as the significance of the study to literature.

Justification of The Study in Research Proposal Example

Read: Child Development Topics for Research Papers

1.7. Significance of the Study

| Significance of the Study in Research Proposal Example

This study is expected to provide benefits to a wide range of stakeholders in the business world. To investors, the findings show the interlinkage between firm size and listed firms’ tax efficiency. They are likely to use the findings to make tax decisions in management decisions in a manner that would maximize shareholder. To market regulators, the findings provide an opportunity to show how firm size is related to the tax efficiency of listed. This linkage can be used to provide information that would help regulators especially the Institute of Certified Public Accountants of XXX and the Capital Markets Authority (CMA) to provide guidelines on the disclosure requirements on tax information. To Revenue Authority and similar authorities, the study is likely to provide information that could help close avenues of tax avoidance as based on size of companies. This can help increase the tax revenue base of such authorities. To scholars, academicians and other researchers, the findings of the study help to bridge the existing empirical literature gap in that they will help show how firm size affects tax efficiency among listed companies. This will therefore provide findings that can be compared to the existing literature and thereby boost the accumulating empirical evidence on this area of academic inquiry. |

Read: Schizophrenia Research Topics

Chapter Two: Literature Review

2.1. Introduction

- The section is used to introduce the chapter.

- It serves as a snapshot of the content of chapter 2.

- It must be as brief as possible.

2.1. Introduction

| Example of introduction in literature review

{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} This chapter presents the review of literature on firm size and tax efficiency. This is divided into theoretical as well as empirical literature review. The theoretical literature review presents theories that try to link firm size to tax efficiency including their inherent limitations in the context of this study. Empirical literature review on the other hand presents the extant studies on this area. The empirical evidence is derived from both local studies as well as from studies from around the globe. Subsequently, the conceptual framework and research gaps resulting from the literature review are presented. |

Read: Medical Research Paper Topics

2.2 Theoretical Framework

The section is used to evaluate the theories that inform the study area. A good theory must help explain how the study variables are related. The theoretical literature review must identify the theory’s proponent, proposition as well as interrogate the theory using extant empirical literature. This may help bring out the theoretical limitations.

Example of Theoretical Framework{Research Title: Effect of Firm Size on Tax Efficiency of Firms Listed at the Securities Exchange} 2.2.1. Corporate Governance Theory Corporate governance theory proposed by Doyle (2007) indicates that firm size has a positive effect on tax efficiency and that the larger the size of a firm, the greater the tax efficiency. The theory which falls in line with the classical economics theory of economies of scale postulates that large firms have highly skilled and capable corporate management teams that help firms identify tax expense management opportunities and thereby exploit them to reduce tax liability. It is such skilled personnel that are able to identify tax efficient investment vehicles and thereby use them to enhance tax efficiency. This theory has been supported by a number of empirical studies. Chen et al. (2016) for instance studied the relationship between tax liability and board characteristics among South Korean manufacturing firms. The findings showed an inverse relationship between board skills diversity and tax liability. Olum (2017) and Eliakim (2015) have reported similar findings. On the opposing side, some studies have found little evidence to support the Doyle (2007) theoretical supposition. Li (2012) for instance found that corporate governance does not affect tax liability of firm. Using board diversity to proxy for corporate governance among medium size firms in Hong Kong, the study found board diversity to have no bearing on tax liability. Similar findings have been registered by Wilkins (2014) and Aromba (2013).

|

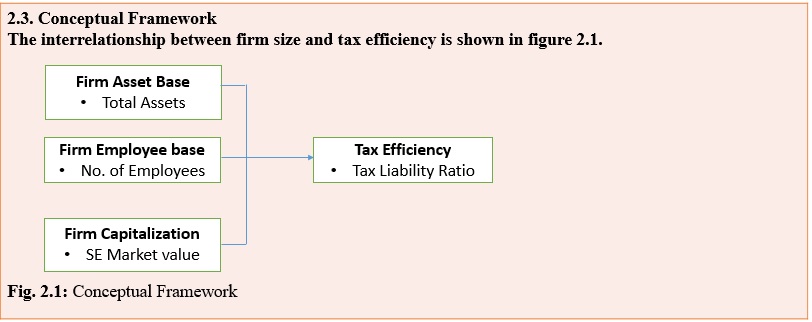

2.3. Conceptual Framework

The section shows a schematic representation of the interrelationship expected between the various variables of the study. It draws from the relationships established from the theoretical literature review. Each variable must then be empirically discussed

2.4. Empirical Literature Review

This form of literature review appraises existing studies related to the area of study. The review involves evaluating the context and scope of the study, the objectives, the design and methodology as well as the findings. One should go ahead and compare such studies with similar and contrasting studies and identify empirical literature gaps.

2.5. Literature Gaps

This section appears at the end of chapter 3 and shows the theoretical, conceptual and empirical short-comings in extant literature.

It highlights the overall shortcomings in the existing literature that is covered by the study. In essence, it corresponds with the research statement of the problem and objectives.

Read: Motivational Speech Topics for Students

2.6. Summary

This is the ultimate section in chapter two that summarizes the theoretical, empirical and conceptual literature covered in the section.

It is a snap-shot of the conclusions arrived at in the course of the literature review.

It must cover:

- Theoretical conclusion

- Conceptual conclusion

- Empirical Conclusion

Chapter Three: Research Methodology

3.1. Introduction

The section serves to introduce the chapter three

3.1. Introduction Example

This chapter provides the basis of testing the research hypotheses of the study and provides the mechanism for achieving the study objectives. It not only provides the research design, but it also defines the study population and sampling technique. It ultimately sheds light of the study model, the descriptive statistics and the tests of hypotheses proposed for the study.

3.2. Research Design

The research design refers to the overall strategy that one chooses to integrate the different components of the study in a coherent and logical way, thereby, ensuring he effectively address the research problem;

It constitutes the blueprint for the collection, measurement, and analysis of data.

3.2. Research Design Example

This study is designed as a longitudinal survey of the value relevance of all the manufacturing companies over a 5 year period spanning January 2013 through December 2017. A longitudinal study as per Shadish, Cook and Campbell (2002) is suitable when observation is to be repeatedly made on the same subjects over a long period of time. In this study size and tax efficiency information of the same listed companies will be collected and analyzed over a 5 year period covering January 2012 to December 2016. Reasonable data capable of analysis is only possible over a multiple period of time that will involve multiple observations of the companies in line with the expectation of Shadish, Cook and Campbell (2002).

3.3. Study Population

Shows all the possible units of analysis

3.3. Study Population illustration

The population consists of all the 65 companies listed at the Security Exchange {SE} as at 31st December 2017. The choice of listed companies is considered to be important because the listed companies are under an obligation to continuously provide financial reports as a pre-requisite for continued listing (SE, 2014). This is necessary in order to collect the prerequisite financial statement and tax data to carry out the study.

The study is designed as a census study. All qualifying companies will be included in the study. The qualifying criteria would be that a company have enjoyed continuous trading over the 5 year period covered by the study. Accordingly, companies delisted from the SE over the study period will be eliminated from the sample. This will allow the study to follow the longitudinal design adopted by focusing on the effect of firm size on tax efficiency of the sample companies over the study period.

3.4. Sample and Sampling Design

The section shows the approach used in selecting the study units from the population.

■Simple random sampling. ■ Stratified sampling

■ Cluster sampling ■ Multistage sampling

■ Systematic random sampling ■ Voluntary sampling

■ Convenience sampling ■ Quota Sampling-

■ Purposive/Judgmental Sampling ■ Snowball sampling

3.4.1. Sampling Frame

3.4.2. Sample Size

3.4.3. Sampling Approach

3.4. Sample and Sampling Design Illustration

The section shows the approach used in selecting the study units from the population

3.4.1. Sampling Frame

The Sampling frame is all the listed companies at the NSE

3.4.2. Sample Size

This study is designed as a census study covering all the 65 companies listed at the NSE as at December 2017.

3.4.3. Sampling Approach

The study is designed as a census study. Accordingly all qualifying companies will be included in the study. The qualifying criteria would be that a company have enjoyed continuous trading over the 5 year period covered by the study.

3.5. Data and Data Collection

Research data is defined as recorded factual material commonly retained by and accepted in the scientific community as necessary to validate research findings; although the majority of such data is created in digital format, all research data is included irrespective of the format in which it is created.

Data collection is a process of accumulating information from all the relevant sources to find answers to the research problem, test the hypothesis and evaluate the outcomes.

Data collection methods can be divided into two categories: secondary methods of data collection and primary methods of data collection since data for the study can be primary data or secondary data.

Secondary data is a type of data that has already been published in annual reports, economic bulletins, books, newspapers, magazines, journals, online portals etc.

Primary data collection methods can be divided into two groups: quantitative and qualitative.

Quantitative data collection methods: are based in mathematical calculations in various formats. Such methods include questionnaires with closed-ended questions, methods of correlation and regression, mean, mode and median and others. Quantitative methods are cheaper to apply and they can be applied within shorter duration of time compared to qualitative methods.

Qualitative research methods: they do not involve numbers or mathematical calculations. Qualitative research is closely associated with words, sounds, feeling, emotions, colours and other elements that are non-quantifiable. Qualitative studies aim to ensure greater level of depth of understanding and qualitative data collection methods include interviews, questionnaires with open-ended questions, focus groups, observation, game or role-playing, case studies etc.

3.5. Data Collection

3.5.1. Research Data

3.5.2. Data Collection Instrument

Illustration of Data Collection in Research project

| 3.5. Data Collection

This section details the data to be used in the study and how it is to be collected. 3.5.1. Research Data Secondary data is to be used in the study to evaluate the effect of firm size on tax efficiency of companies listed at the Securities Exchange. The data will be obtained from the semi-annual accounts of listed companies as well as the Securities Exchange trading data database. Semi-annual data on total assets and tax expense will be collected from the semi-annual financial statements of companies listed at the SE. Data on outstanding shares and share prices will be obtained from the SE trading data-base. The data will be used to measure firm size and tax efficiency. 3.5.2. Data Collection Instrument Data will be collected using a secondary data collection sheet as specified in appendix I |

3.6. Data Analysis and Presentation

Frequently Asked Questions in Research

Importance of Research

Review existing knowledge and generate new knowledge

Investigate existing situations or problems and provide solutions.

Construct or create new procedures or systems.

Explain existing phenomena.

Explain empirical gaps, conceptual gaps, and theoretical gaps.

How to Identify a Good Research Topic

Where can you identify a good research topic? There are several ways to identify a good Research topic as indicated below.

- Brainstorming for ideas.

- Evaluating suggestions for further research from existing studies.

- Observation of existing situations and phenomena.

- Reading from current practical problems.

- Reading from observed studies and checking out solution gaps.

- Reading from literature and checking out any information gaps.

- Reading of theoretical literature and checking out theoretical gaps

Find :Demonstration Speech Ideas, Examples, and Topics

What are the main types of Research

- Exploratory research: exploratory research is undertaken when there is few or no previous studies exist. The aim is to look for patterns, or ideas that can be tested and will form the basis for further research. Typical research techniques would include case studies, observation and reviews of previous related studies and data.

- Descriptive research: Descriptive research can be used to identify and classify the elements or characteristics of the subject, e.g. number of days lost because of industrial action. Quantitative techniques are most often used to collect, analyze and summarize data.

- Analytical research: analytical research often extends the descriptive approach to suggest or explain why or how something is happening, e.g. underlying causes of industrial action. An important feature of this type of research is in locating and identifying the different factors (or variables) involved.

- Predictive research: the aim of predictive research is to speculate intelligently on future possibilities, based on close analysis of available evidence of cause and effect, e.g. predicting when and where future industrial action might take place.

Characteristics of A Good Research Topic

A good research topic should have the following characteristics.

- Clarity: The topic should be clear so that others can easily understand the nature of the research. It should have a single interpretation to avoid confusion. It should be free of any ambiguity.

- Well-defined: It should be well-defined and well-phrased and it should be easy to understand. It should have a single meaning.

- Simplicity: Avoid technical terms unless it is necessary. Use easy words that everyone can understand, additionally avoid unethical terms and any sort of bias in the research topic.

- Contemporary: Should have current importance. One must also assess how much the topic will provide benefit to the field in which the study is conducted.

- Variables: must identify the dependent and independent variables of the study.

- Focus: It must be in the discipline of inquiry you wish to study.

- Brevity: Must be brief and concise.

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.