Contents

- Mpesa Transaction Charges Calculator

- M-Pesa Charges Calculator

- Mpesa Charges Chart - Charges for Mpesa

- Mpesa Transaction Charges - Mpesa Sending Charges Chart

- Mpesa Charges Sending Money to Other Mobile Users

- Mpesa Agent Withdrawal Charges

- Mpesa ATM Withdrawal Charges

- Mpesa transactions

- Frequently asked questions about Mpesa Charges

- Mpesa Cost Disclaimer

Mpesa Charges: Searching for the new Mpesa withdrawal charges and new Mpesa transfer charges? Or do you want to know how much it costs to send money via Mpesa? Find Mpesa charges below:

Mpesa Transaction Charges Calculator

Quickly and accurately estimate fees for various M-Pesa transaction Charges. This calculator enables you to make informed decisions.

M-Pesa Charges Calculator

Mpesa Charges Chart - Charges for Mpesa

c

Read: Online Jobs in Kenya That Pay Through Mpesa

Mpesa Transaction Charges - Mpesa Sending Charges Chart

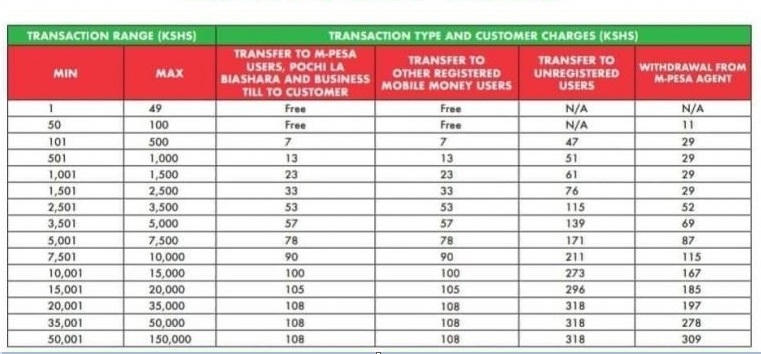

| Min(KSh) | Max(KSh) | M-PESA Charges |

| 1 | 49 | Free |

| 50 | 100 | Free |

| 101 | 500 | 7 |

| 501 | 1,000 | 13 |

| 1,001 | 1,500 | 23 |

| 1,501 | 2,500 | 33 |

| 2,501 | 3,500 | 53 |

| 3,501 | 5,000 | 57 |

| 5,001 | 7,500 | 78 |

| 7,501 | 10,000 | 90 |

| 10,001 | 15,000 | 100 |

| 15,001 | 20,000 | 105 |

| 20,001 | 35,000 | 108 |

| 35,001 | 50,000 | 108 |

| 50,001 | 150,000 | 108 |

Read: How to Report Mpesa Fraudsters

Mpesa Charges Sending Money to Other Mobile Users

| Min(KSh) | Max(KSh) | M-PESA Charges |

| 1 | 49 | Free |

| 50 | 100 | Free |

| 101 | 500 | 7 |

| 501 | 1,000 | 13 |

| 1,001 | 1,500 | 23 |

| 1,501 | 2,500 | 33 |

| 2,501 | 3,500 | 53 |

| 3,501 | 5,000 | 57 |

| 5,001 | 7,500 | 78 |

| 7,501 | 10,000 | 90 |

| 10,001 | 15,000 | 100 |

| 15,001 | 20,000 | 105 |

| 20,001 | 35,000 | 108 |

| 35,001 | 50,000 | 108 |

| 50,001 | 150,000 | 108 |

Read also: MySafaricom App

Mpesa Agent Withdrawal Charges

Find mpesa charges for withdrawing or Withdrawal Charges for Mpesa from an Agent. These mpesa withdrawal rates will enable you make the best decision.

| Min(KSh) | Max(KSh) | M-PESA Charges |

| 1 | 49 | N/A |

| 50 | 100 | 11 |

| 101 | 500 | 29 |

| 501 | 1,000 | 29 |

| 1,001 | 1,500 | 29 |

| 1,501 | 2,500 | 29 |

| 2,501 | 3,500 | 52 |

| 3,501 | 5,000 | 69 |

| 5,001 | 7,500 | 87 |

| 7,501 | 10,000 | 115 |

| 10,001 | 15,000 | 167 |

| 15,001 | 20,000 | 185 |

| 20,001 | 35,000 | 197 |

| 35,001 | 50,000 | 278 |

| 50,001 | 150,000 | 309 |

Mpesa ATM Withdrawal Charges

Find Mpesa ATM Withdrawal charges. These Safaricom Mpesa rates for ATM Withdrawal will guide you on the amount you want to withdrawal from your M-pesa through ATMs

Mpesa transaction rates or Charges vary according to the amount of money you want to withdrawal from the ATM

| Min(KSh) | Max(KSh) | M-PESA Charges |

| 200 | 2500 | 35 |

| 2501 | 5000 | 69 |

| 5001 | 10000 | 115 |

| 10001 | 35000 | 203 |

Read: How to Get Mpesa Statement

Mpesa transactions

- Maximum Mpesa Balance -Kshs 500,000/=

- Maximum Mpesa Transaction per day -Kshs 500,000/

- Maximum amount per transaction is Kshs.250,000

- At an Mpesa agent, you cannot deposit money directly into another M-PESA customer's account directly. You have to deposit the cash into your account first then transfer to the other person

- One earns Bonga points when they transact on M-PESA.

- To transact or register at any M-PESA Agent, you will be needed to identify yourself by producing your original identification document, that is National ID, Military ID, Passport, Diplomatic ID or Foreigner Certificate or Alien ID

Frequently asked questions about Mpesa Charges

1. How much can Mpesa hold?

Kshs 500,000/=

2. What is the maximum amount of money you can send via Mpesa per transaction?

Kshs.250,000

3. What is the Minimum amount to send through Mpesa

Kshs 50/=

4. What is the Minimum amount I can withdrawal through ATM?

Kshs 200

5. How much does it cost to withdraw 5000 from Mpesa?

Kshs 69/=

6. How much does it cost to send 1000 via Mpesa?

Kshs 13/=

Mpesa Cost Disclaimer

It's essential to note that M-Pesa fees are subject to change, and variations may occur based on factors such as transaction amounts and types. Stay informed about the latest fee updates.

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.