Contents

- How to Check Equity Bank Account Balance through Equitel

- How to Check Equity Bank Balance Online

- How to Check my Equity Account Balance Using Safaricom line

- Equity Bank Kenya Paybill Number

- How to Deposit Money into my Equity Bank Account through M-PESA PayBill Number 247247

- Equity Bank Kenya Loan Calculator

- Equity Bank Kenya Opening and Closing Hours

- Equity Bank Kenya Swift Code

- Equity Customer Care Contacts Kenya

- Equity Bank Supreme Branches

How to Check Equity Bank Balance: Equity Bank is one of the leading banks in Kenya. The bank is one of the most preferred banks in Kenya. Banking became easy and accessible to most Kenyans because Equity Bank did not choose or discriminate against any of its customers. If you want to check your equity bank balance there are several ways to do so as illustrated below.

How to Check Equity Bank Account Balance through Equitel

If you have an Equitel you can easily check your Check Equity Bank Account. Below are steps you will know your account balance.

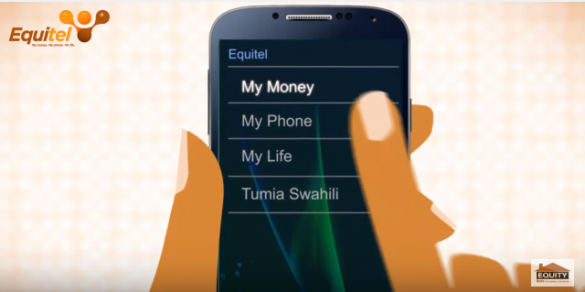

1. On your phone, Go to your Equitel Menu

2. Select My Money

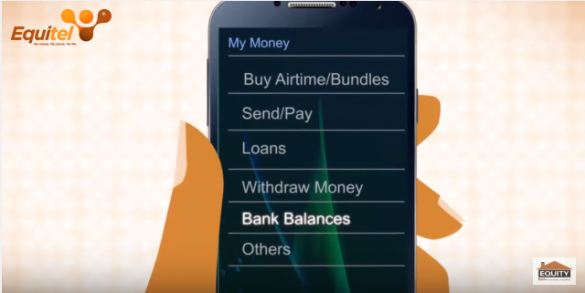

3. Select Bank Balances

Read: List of Equity Bank Branches in Nairobi

4. Select Account

5. Select the account number or card

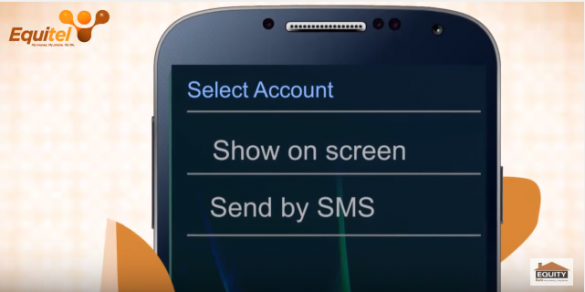

6. Select how you would like to receive your balance. – Show on the screen or receive an SMS

Read: NTSA TIMS – Login, PDL Application & NTSA Vehicle Search

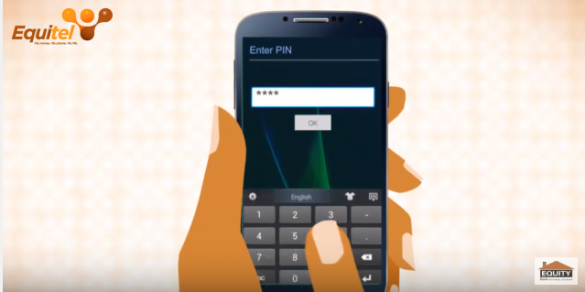

7. Enter your PIN

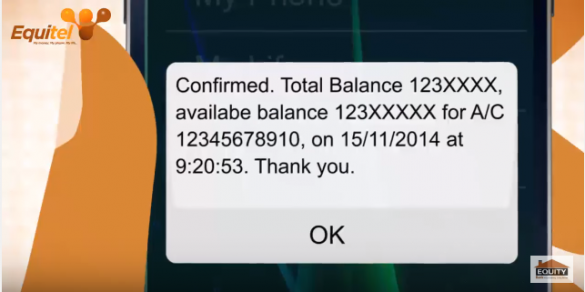

8. You will receive a confirmation SMS showing your bank account balance!

How to Check Equity Bank Balance Online

If you are in digital banking/online banking, getting to know your Equity Bank balance is easier as shown below

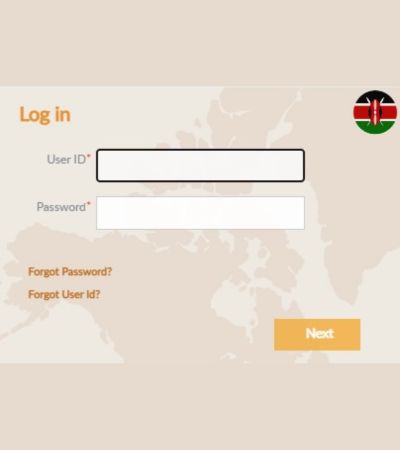

Step 1: Search for the official equity bank website or online platform {https://online.equitybankgroup.com/}

Step 2: Select the country ( Kenya, Rwanda, Uganda, Tanzania or South Sudan}

Read: List of Best Wedding Planners in Kenya

Step 3: Login using the credential used when creating your account {User Id and Password}

Step 4: A verification code will be sent to your authorized phone number, enter it in the required section

Step 5: Once you login your available bank balance in the summary details of your account

How to Check my Equity Account Balance Using Safaricom line

If you don’t have an Equitel line or you don’t prefer online banking you can still know your Equity Bank balance through your Safaricom line. Follow the following steps which also let you how to check equity bank balance via phone

Step 1: Use your Safaricom line and dial *247#

Step 2: From the options displayed, choose option 1, which is balance, and press enter on your dial pad.

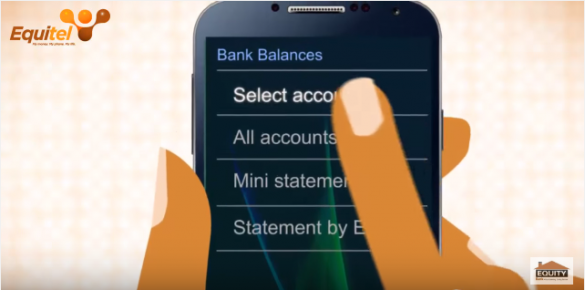

Step 3: The next screen presents you with four options, including select account, all accounts, mini statement, and statement by email.

Step 4: Depending on your preference, select the appropriate option to view your account balance.

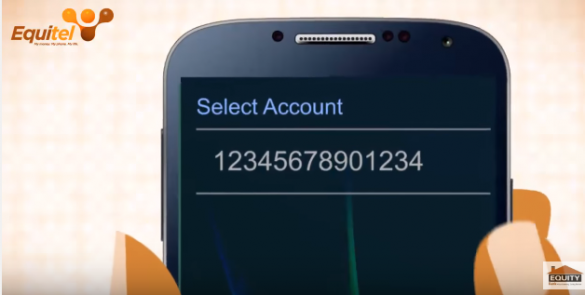

Step 5: If you choose the select account option, a screen with all your available accounts will appear, and you can choose the account you want by pressing enter.

Step 6: Next, select your preferred way of receiving the balance information, either via SMS or on the screen.

Step 7: Finally, validate the transaction by entering your mobile banking PIN, and your account balance notification will be sent to you via SMS or displayed on the screen.

Read: List of Registered SACCOS in Kenya

Equity Bank Kenya Paybill Number

To make banking more accessible, Equity bank has adopted different measures like using your Mpesa to deposit cash using the Equity paybill number. Equity Bank Kenya Paybill number is 247247.

For all customers having Equity bank accounts to be able to use Equity Bank Kenya Paybill number you will need to follow the following steps

- Open M-Pesa menu, and choose-Lipa na M-Pesa

- Choose –Paybill

- As the Business number enter 247247 which is the Equity bank paybill

- Enter your account no as the Equity Bank account number

Business no: 247247

Account no: 0910245xxxxxx

- Input/Enter the amount: This is the amount of money you want to deposit into your account

- Input your M-PESA PIN

- Ensure to properly check and confirm all the details

- Mpesa message will be sent to you confirming your deposit to your Equity account,

- Equity Bank message will shortly follow also confirming the deposit

It is good to note the above transaction can only be done by someone having an Equity bank account.

Read: List of Charitable Organizations in Kenya/ Foundations in Kenya

Advantages of using Equity Bank Kenya Paybill number

- It is very fast and convenient and can make a deposit any time of the day.

- It saves time as one will not waste any time in the banking hall

- Using you phone you can be able to easily trace all the payments without the need of getting a bank statement

How to Deposit Money into my Equity Bank Account through M-PESA PayBill Number 247247

- Go to Safaricom SIM Tool Kit

- Select M-PESA menu

- Select Lipa na M-PESA

- Select Pay Bill

- Select Enter Business no.– Enter Equity Bank’s Lipa na M-PESA PayBill Number 247247 and press OK

- Select Enter Account no.– Enter your Equity Bank Account Number (e.g. 0900 xxxx xxxx) press OK

- Enter Amount -Enter the amount you wish to deposit and press OK

- Enter your M-PESA PIN and press OK

- Confirm all the details are correct and press OK

- You will receive a confirmation SMS from M-PESA.

- Equity Bank will also send you a confirmation SMS.

Read: How to Get Mpesa Statement

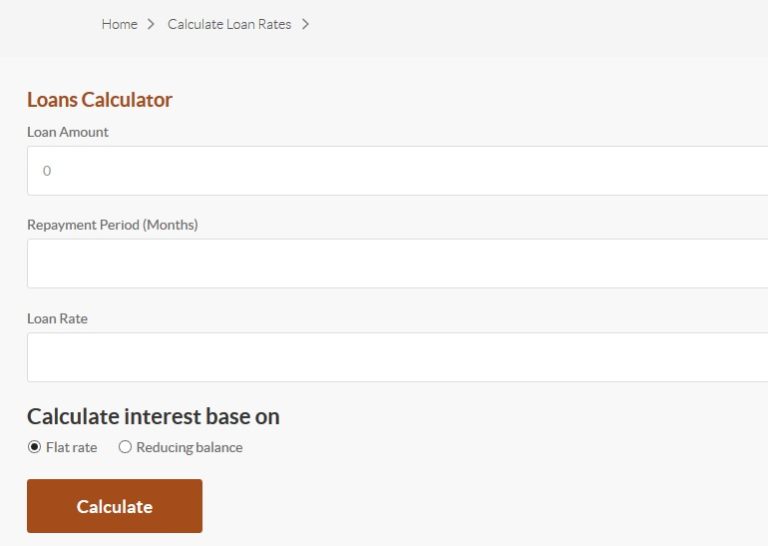

Equity Bank Kenya Loan Calculator

Looking for Equity Bank Kenya Loan Calculator? Before you take an Equity bank Kenya loan, you might want to check the rate to pay or amount to be paid monthly.

You can easily find Equity Bank Kenya Loan Calculator on their website.

1. Go to Equity Bank Kenya Loan Calculator Page

2. Enter Loan Amount

3. Enter Repayment Period (Months)

4. Enter Loan Rate

5. Calculate interest base on (select one option depending on the type of interest being offered)

- Flat rate

- Reducing balance

6. Click calculate

The Equity Bank Kenya Loan Calculator will give you the

- Monthly Payments:

- Number of Payments:

- Total Interest:

- Total Payment:

NB: Visit a branch near you for more details.

Equity Bank Kenya Opening and Closing Hours

Find Equity Bank Kenya Opening and Closing Hours. Working hours for Equity Bank differ in various branches. In most branches the opening hour is 8:00 am and closing is 4:00PM or 4:30 PM. Below we is list of the working hours for various branches.

Equity bank Moi Avenue opening and closing hours

9 AM- 5PM

Equity bank Kimathi Street opening and closing hours

8 AM-4:30 PM

Equity bank Mama Ngina Street opening and closing hours

8 AM- 4PM

Equity bank Four Way opening and closing hours

8 AM -8PM

Equity bank Kenyatta Avenue opening and closing hours

8 AM – 5PM

Equity bank Westlands opening and closing hours

8AM – 4:30PM

Equity bank Gigiri opening and closing hours

8 AM-4:30 PM

Equity bank Ngara opening and closing hours

8 AM-4:30 PM

Equity Bank Kenya Swift Code

The Equity Bank Kenya Swift Code will be used when you are doing bank transfers, and wires.

A Swift Code is a digit code that is used to identify the financial institution. Equity Bank Kenya Swift Code are used to process wire funds transfers, and direct deposits, bill payments, and other automated transfers. It is mainly used for international wire transfers between banks

The Swift code consists of 8 or 11 characters. When 8-digits code is given, it refers to the primary office. The code formatted as below;

Swift Code Format

AAAA BB CC DDD

- AAAA – First 4 characters – bank code (only letters)

- BB – Next 2 characters -2 country code (only letters)

- CC – Next 2 characters – location code (letters and digits) (a passive participant will have “1” in the second character)

- DDD – Last 3 characters – branch code, optional (‘XXX’ for primary office) (letters and digits)

Equity Bank Kenya Swift Code

Equity Bank Kenya Swift Code is EQBLKENA

Equity Customer Care Contacts Kenya

You can contact customer care using the below contacts

Equity Bank Kenya provides Inclusive Financial Services that transform livelihoods and expand opportunities.

HEAD OFFICE

Upper Hill – Hospital Road, Equity Centre, 9th floor,

Address :

P.O.Box 75104-00200, Nairobi.

Pilot Lines:

+254763026000

Fax: 020-2737276

Email: info@equitybank.co.ke

Contact Centre:

0763063000

Contact Centre Email:feedback@equitybank.co.ke

Shares: shares@equitybank.co.ke

Customer Care:customercare@equitybank.co.ke

Loans: loans@equitybank.co.ke

Website: www.equitybankgroup.com

Equity Bank Supreme Branches

Equity Bank Supreme Branches are meant to meet the needs of high end customers. For one to have an account at supreme branches you will need to a minimum account balance of Kshs 200,000/=. Customers operating supreme bank account are more advantaged and banking comes with better customer service like availability of a personal bank relationship manager, elegant lounges, free internet once in the banking hall, longer banking hours and easiness in operating their accounts in major global currencies like the dollar and pounds.

Below is the list of Equity Bank Supreme Branches

1. Equity Bank Westlands Supreme Branch

Location: Westlands Nairobi, Westlands Square

Ground Flr, Next To Uchumi

Contact details

Tel: +25420239819

Mobile no: 0707648668

Mobile no: 0731688471

- Equity Bank Community Supreme Branch

Location: Community, Upperhill

NHIF Building 1st Flr

Ragati Rd, Community

Contact details

Telkom Line: 020 2262023

Safaricom no: 0711-026023

Airtel no: 0732-112023

3. Equity Centre Supreme Branch

Location: Upper hill, along Hospital road

Equity Centre Building, Ground Floor

Contact details

Direct Line: 020 22 62 010

Safaricom no: 0711 026 010

Airtel no: 0732 026 010

4. Equity Bank Kilimani Supreme Branch

Location: Kilimani, Alpha Towers, 2nd Floor

Opposite Yaya Centre, along Argwings Kodhek Rd

Contact details

Mobile: +254 708 985773

5. Equity Bank Lavington Supreme Branch

Location: Nairobi, Lavington Green, Opposite Lavington United Church

Contact details

Telkom number : +254202396824/5

Safaricom number: 0707 648666

Airtel number: 0731 688293

6. Equity Bank Mayfair Supreme Branch

Location: Nairobi, Mayfair Centre Building, Ground Floor

Ralph Bunche Road, across Argwings Kodhek Rd

Contact details

Telkom number: 020 268 9904/7

Safaricom number: 0708 985746

Airtel number: 0731 688555

7. Equity Bank Nyali Supreme Branch

Location: Nyali Super Centre

Links Road Bamburi – Mombasa

Contact details

Telkom number: +254 20 2396826/7

Safaricom number: 0707 648659

Airtel number: 0731 688321

8. Equity Bank Thika Supreme branch

Location: Thika town, Section 9

Along Thika Kenyatta Highway

Contact details

Safaricom number: 0715 818554

Airtel number: 0739 500008

Telkom number: 020-2507420 & 020-2507421

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.