Contents

Best Loan Apps in Kenya: Those days are gone when you needed to visit a bank or Sacco physically to apply for a quick loan or instant loans. Traditional credit facilities are quickly being overtaken by mobile loan apps.

The financial industry is changing at a very fast rate. Since the introduction of Apps, they have revolutionized the financial services in Kenya. More and more Loan Apps are being developed and others are being improved to provide quality services.

Using the mobile loan apps in Kenya, more Kenyans can now access instant mobile loans in Kenya from the comfort of their homes or work.

An amazing thing is that anyone can access loans in Kenya without security. Days are gone when you needed a guarantor.

There is a range of apps that can be downloaded from the play store or App store. The choice is yours on which Loan Apps in Kenya to use.

Mobile Loan Services In Kenya – Best Loan Apps in Kenya Without Registration Fee

Want instant online loans in Kenya; Get one of the following top 20 loan apps in Kenya. Download Today. There are other apps in Kenya or mobile loan services in Kenya that are being developed every day. Find our contacts and drop us an email to update the list.

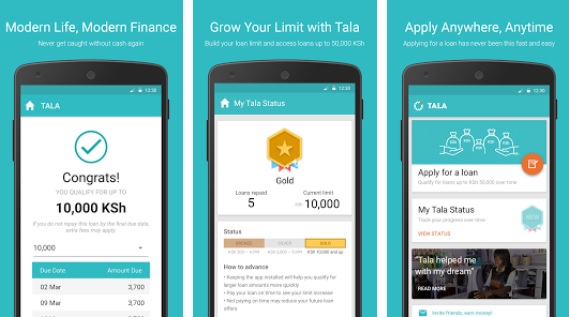

1. Tala App – Loan Lending app in Kenya

Tala App enables you to access a loan of up to Ksh. 30,000 anywhere and anytime. It is one of the best instant loan apps in Kenya. Once you apply it’s approved in seconds. Tala loan is accessed through M-Pesa.

Tala Kenya is a finance app that provides credit at your fingertips. All with low fees and an easy repayment schedule of up to 61 days. You can easily get Tala App Download on Google Play Store.

The App is being updated from time to time to make it better and user-friendly. The app allows you to check your credit limit as well as view successful stories from loan beneficiaries.

Find Also: Genuine Shylocks in Nairobi – Quick Loans in Nairobi

Tala loan limit Kenya

The current maximum loan limit in Tala App is KES 30,000. For first-time applicants’ loan limits may vary. Tala uses the information you provide such as income, current job, and other information stated in their privacy policy to determine what loan limit they will give.

If you are consistent in paying your loan the limit will go up and it can even double within two months

How to apply for a loan using Tala App?

- Download the Tala app from the Google play store

- Using your national ID, fill out a short application

- If approved for a loan, approve your amount and the payment period

- Finally, your loan will be directly sent to MPESA.

Note: When you download Tala App, it will ask for permission to scan your M-Pesa SMS and other information so as to verify your identity and creditworthiness.

As more and more new loan apps are coming up in Kenya, Tala loan mobile app remains to be among the top 20 loan apps in Kenya. It offers genuine loans

Mobile Loans in Kenya

Read: Tala App Download

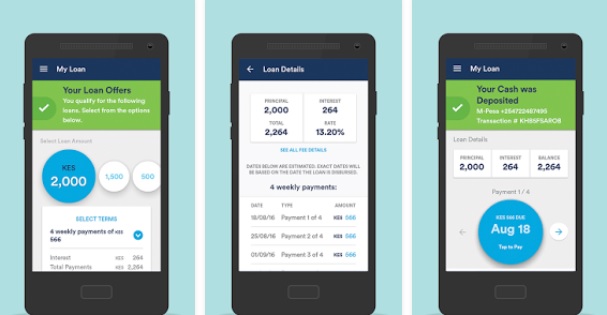

2. Branch App

Branch App is a bank in your pocket. Branch loans are very accessible and 100 percent genuine. You can access it anywhere and anytime. The branch uses technology to provide credit facilities to the users.

Branch Loan Kenya makes it easy for anyone to access credit in Kenya. All you need is to download Branch App, complete the application and receive your loan straight to your mobile money account. Visit google play store for branch loan app download.

You can be assured that loans from branch are convenient, fast, and reliable in offering instant mobile loans in Kenya.

It provides support to its users 24 hours a day, messages them within the app, and receives an answer in minutes.

Branch Loan Limits

The current loan limit ranges between Kes 250 to Kes 100,000/=

How to use Branch App

- Download Branch App

- Create your account using a Facebook login

- Then apply for a loan

- You will receive your loan in your M-Pesa account

Build your loan limit by making repayments on time

It offers loans of up to Kes 100,000, one of the best options if you need to access small loans in Kenya.

Branch does not require any paperwork, collateral, or visiting their office. Its fees are very friendly and do not charge late fees or rollover fees.

3. Berry Loan App

Berry is one of the money lending apps. It offers flexible loans which are quick and convenient. It makes it easy for anyone to access credit anywhere and anytime in Kenya.

Applying for a Berry Loan App will require you sent to then your Mpesa statement.

Berry Loan App Download

Go to the google play store on a mobile phone

Search for Berry Loan App

Download and install

Register yourself by filling in the required details

Berry Loan App Credit Limit

Kes 500 to Kes. 50,000

How to apply for loan

Open your Berry app

Select Apply for a loan

Submit your Mpesa Statement

Choose the Loan product you prefer

If approved, you will get your money in your Mpesa

Berry Loan Contacts

To contact Berry, you can email them through support@berry.ke or a raise a ticket through your App

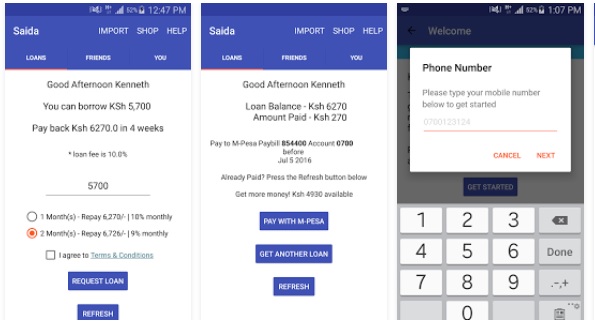

4. Saida App – Money Lending app in Kenya

Saida offers fast and convenient loans through your M-Pesa. You can get quick unsecured loan on Saida to expand your business or sort out your emergencies.

Saida enables you to access loans of up to Ksh. 25,000. Install the Saida App to know if you are eligible for a loan. Not everyone is eligible for Saida loans. If not eligible for a loan, Saida will explain why and advise on how to be eligible.

The repayment period can be up to three months and interest rates is as low as 7.5%. The rate is tailored to each customer.

When joining or borrowing a loan, you start with the smallest amount, the loan limit increases as settle your payment on time.

How Saida Works

- Download Saida App

- Create a Saida account. Answer a couple of questions for Saida to know you better.

- Saida will check your creditworthiness. It does this by checking if you have been using your phone to make calls, data, SMS, and the way you use your mobile money services.

- Saida will notify you of the amount of money you can apply for.

- The money is sent to your M-Pesa account immediately

- The repayment terms are explained.

5. Zidisha App

Zidisha is an international lending community that offers responsible, achieving people a chance to raise loans directly from ordinary people across the globe.

It’s an online microlending community that directly connects lenders and entrepreneurs. It bypasses the expensive local banks and intermediaries that charge very high-interest rates and offers a person-to-person platform that enables lenders and entrepreneurs to communicate openly and instantly.

Why Use Zidisha?

It’s open to everyone: Collateral assets, bank accounts, guarantors, or salaried jobs to raise a loan are not required.

The fee charges are very affordable, each loan attracts a 5% service fee.

The repayment terms are flexible: one chooses their own weekly repayment schedule.

Loans are funded by other Zidisha members.

6. Utunzi App

Utunzi App enables you to access unsecured personal loans in Kenya through your mobile. This Kenya money App: Utunzi mobile loan app enables you to access finance at any time and anywhere in Kenya.

The app is fast and easy to use. You will get a quick loan approval decision.

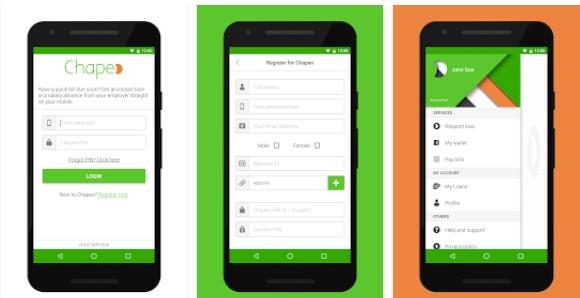

7. Chapeo Capital

Chapeo capital provides short-term credit solutions, payroll processing functionalities, employee advances, and bill payment options at the convenience of one’s workstation via mobile phones.

The interest on the borrower who are using the app to get money is very minimal. At times you might need some quick money. The best places to turn to for a money loan are Kenya mobile loans App and Chapeo capital being one of Kenya loans Apps to get a loan in Kenya. Get Chapeo loans

8. Okash Loan App

The Okash app makes it easy for you to access credit anywhere and anytime. Application is easy and you receive your loan in no time. You will receive your loan through your M-pesa Account.

The Okash app makes it easy for you to access credit anywhere and anytime. Application is easy and you receive your loan in no time. You will receive your loan through your M-pesa Account.

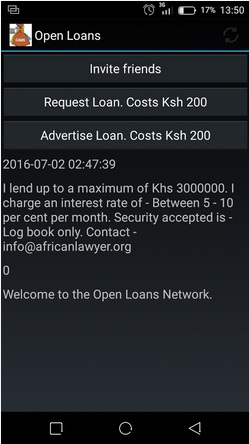

Open Loans Kenya App: Business Loans in Kenya

Open Loans Kenya App is a social network that enables borrowers to access loans from millions of lenders in Kenya.

The app also allows lenders to have direct access to millions of borrowers.

It gives information from M-Pesa lenders to traditional salary advance companies to instant mobile loans in Kenya.

Open Loans Kenya connects borrowers and lenders all over the country; it does not matter where you are. The idea of Open Loans Kenya is to create an efficient marketplace of loans in Kenya: Business Loans Kenya.

An individual in Kenya with excess cash can use the app as a way to invest. They can lend the money to other borrowers or person they find on the platform and earn interest. To ensure they are secure they can take possession of items such as title deed or car as security. What a great opportunity to invest. Get the app Today! Get a small business loan application on Open Loans Kenya.

Open Loans Kenya enables borrowers in Kenya to borrow from private persons as well as banks and other financial institutions in Kenya that they find on the platform.

It’s legal for anyone to lend money in Kenya. The Banking Act (CAP 488 of the Laws of Kenya) only regulates people who take one person’s money for onward lending to another person. If you are lending your own money you do not a banking licence.

New Loan Apps in Kenya 2022/ Approved Loan Apps in 2022.

Below are some of the new loan apps in Kenya, including those approved loan apps in 2022.

9.DirectCash

Direct Cash is a professional loan platform for mobile users. It is one of the best loan apps in Kenya without a registration fee.

Direct Cash enables you to get a loan anywhere and anytime. The loan application on direct cash is secure and safe.

The app does not disclose a customer’s information without the customer’s consent. You can borrow from Ksh.1,500 – Ksh.50,000 and receive it directly to your M-Pesa.

Download this reliable loan app in Kenya from the Google play store.

10. Zenka Loan App – Genuine Loan Apps in Kenya

Zenka is one of the most flexible and legit loan apps in Kenya. The loan app gives you more control of your finances with its unique features.

The app is designed in such a way that it’s simple to use. Has an easy registration and application process.

After your loan has been approved, you will receive your loan straight to your M-Pesa account.

It has a loan limit of Ksh 30,000

Download this reliable loan app in Kenya from Google play store

11. Kashbora Loan App

Kashbora Loan App is not limited to profession, income, or any other conditions. It offers loans to individuals aged between 18-55 years. If you have a fixed income and phone number you can apply for a loan.

12. Apesa – Reliable Loans Online

Apesa app is one of the most reliable lending money platforms. It offers users safe lending. You can borrow up to Ksh 50,000. Complete the application in 3 steps, easily obtain loans, no need to go out, no mortgage, no prepayment fees, and complete the application online.

This app offers high-quality and low-interest loan products. Apply and receive money on the same day.

13.CreditHela – Credit Loan App

This is one of the genuine loan apps in Kenya. It enables you to borrow from Kes 1,500 to Kes 80,000.

CreditHela will enable you to get safe loans just through a few clicks from your mobile phone.

14.CashNow – Safe Credit Loan

CashNow is an app that offers loans from KSH 3,000 to KSH 50,000. The interest rate ranges from 5% – 35.5%. CashNow may from time to time make interest-free loans available to customers. The total amount that may be borrowed as an interest-free loan will be subject to CashNow’s sole discretion and subject to our terms of service.

Download the app from the Google app store.

15.OPesa App

Looking for top 20 loan apps in Kenya? OPesa is one of them. It offers safe loans to Kenyans between the age of 18-55 years. Their maximum Annual Interest Rate is 36 percent.

OPesa App Loan Limit

Kes1,500 to Kes. 50,000.

Payment period: From 91 days to 365 days.

Kes1,500 to Kes. 50,000.

Opesa Customer Care Number

Tel: +254-207650999.

Location: Ring Road Parklands, Apollo Center, Sarit Centre Nairobi

Opesa app download

Visit Google play store

Download the app

16. Creditmoja Loan App

Creditmoja was created by individuals who hoped to offer better financial solutions through mobile phones. As one of the loan apps in Kenya, they offer instant loans with Annual Interest rates ranging between 10 to 50 percent.

Creditmoja Loan App loan limit

2500 Ksh ~ 50,000 Ksh.

Loan repayment term: 91-180 days.

How to apply for loan in Creditmoja App

Download app from the Play Store.

Register an account.

Select the product you would like to apply for.

Fill out your basic information, then submit the application.

Receive your loan straight into your M-pesa account.

Loan Eligibility: Kenya Resident between 20-55 years old

Creditmoja customer care number

Email:help@creditmoja.com

Location: Mombasa Road, Nairobi, Kenya

17.KesLoan

KesLoan app is intended for Kenya Citizens who need cash instantly. Once you download the app from Google Play store and take a few steps to apply, customers can get convenient loans

They offer loan repayment period between 91 days to 365 days

KesLoan loan Limit

Kes. 7,000 to Kes. 100,000

How to download and Apply for a loan through KesLoan

Visit Google play store

Install KesLoan App

Register with your phone number

Identity in 3 steps through the app

Wait for the review result

If approved, wait for the cash to your M-Pesa

Repay your loan

KesLoan Customer care number

Email: service@kesloan.com

Location: Diamond Park Avena Road House 314

18. MyKes Loan App

MyKes app is a good loan app that has affordable loans. Its loan interest is fair as it caters to the needs of young people. It offers a reliable loan because the same day you apply for the loan you get it as long as you meet their loan approval criteria.

They offer loans for clients above 20 years and must have e national ID. Their loan repayment period is 91 days (shortest) and the longest is 365 days or 1 year.

The maximum Interest rate is 18 percent

MyKes Loan Limit

Loan amount: KSh 5,00.00 – KSh 2,000.00

MyKes customer care number

Phone: 0207903622

19. Flashpesa App

20. Loan Pesa

21. Lendplus

CBK Approved Loan Apps in 2022.

22. Ceres Tech Limited

23. Getcash Capital Limited

24. Giando Africa Limited, trades as Flash Credit Africa

25. Jijenge Credit Limited

26. Kweli Smart Solutions Limited

27. Mwanzo Credit Limited

28. MyWagepay Limited

29. Sevi Innovation Limited

30. Rewot Civo Limited

31. Sokohela Limited

Conclusion: Loan Apps in Kenya

More and more apps are being developed each day. You can now access personal loans in Kenya through your Mobile apps anywhere and anytime. Get access to unsecured mobile loans in Kenya; Download a choice of your loan Apps in Kenya.

These Loan Apps in Kenya mostly do not require any Registration Fee

Which are your favorite Loans Apps in Kenya or apps loans? Or have one you have used to be loaned money and not included. Comment Below or Drop us an email to update the list

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.