How to file a company’s annual returns on eCitizen: Do you know how to file online annual returns for a company in Kenya? Have you filed your company’s annual returns to the registrar of companies? If you have not, you should do so to avoid being charged penalties. It is good to note that it is a requirement that every registered company files its annual returns to reflect any changes regarding shareholders, directors, addresses, or registered office.

Currently, in Kenya, it is easy to file your company’s annual returns online through eCitizen. To help you understand the whole process we have looked at a step-to-step guide on how to file your company’s annual returns or filing annual returns on eCitizen

How to File a Company’s Annual Returns on eCitizen

Below are simple steps on how to file annual returns on eCitizen

- Create an eCitizen Account

If your limited company was registered or incorporated before the introduction of eCitizen you need to have an eCitizen account if you don’t have one. Visit the eCitizen website and create an account.

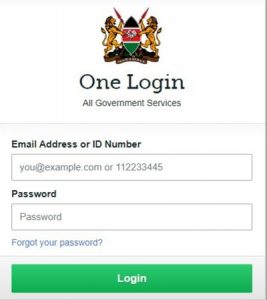

- Log in to your eCitizen

After you have successfully created the eCitizen account login using the details you have used when creating the account.

- Select Business Registration Services {BRS}

After you have successfully logged into the account, select the business registration service. This selection leads you to the business registration service portal.

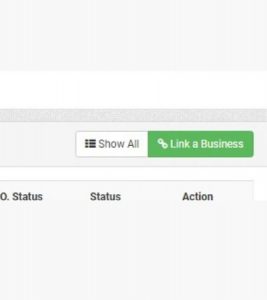

The first thing you should do is link your company to eCitizen. Linking means submitting your company’s information to the registrar for approval.

To link your company, click on the green tab at the right corner, then type either your company’s name or registration number and search.

Once you have found your company, select it and enter information that the system will prompt you to such as the directors, postal addresses, and the company’s physical address.

- Verification

Once you have given the required information, wait for the registry to validate and approve the same. In case of any errors or changes needed, you will be notified. The approval may take several working days {Roughly 1 to 4 days}

Find: eCitizen Account

Online Filling of Annual Returns to Registrar of Companies

- Filling

NB: If your company was registered online, the above process may not be necessary unless you have not linked your company. Now to file your return

After the above details have been verified you can go ahead and file your annual returns. Follow the following steps

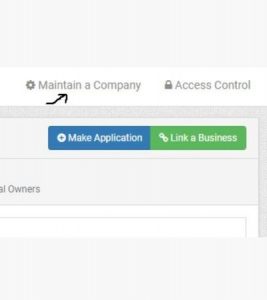

a} To file your return, select the company you want to file the returns.

b} On the page that opens, at the top right of the screen and click on the maintain a company tab.

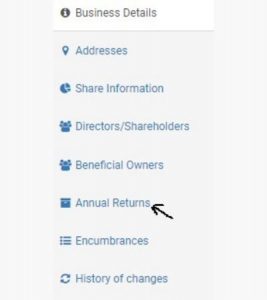

c} Once the tab opens, click on the annual returns option on the left side of your screen.

d} Choose the year you want to file the return and download the return. Fill in the required information then scan and upload it.

- Payment

After submitting the scanned documents, you will need to pay. The amount will depend if it is a late return or an on-time return. An annual return to the registrar of companies is considered late if more than one year has passed from the date of its registration or incorporation

The amount will be calculated by the system.

- Print the receipt

The system will subsequently generate a receipt once you make the payment. You can download and print the receipt.

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.