Looking for Kenya Car Import Duty Calculator? Want to know how much it will cost you to import a car into Kenya.

Kenya Car Import Duty Calculator – How to Calculate Import Duty

Below is how to calculate Kenya Car Import Duty using the Kenya Duty Calculator

Go to Kenya Car Import Duty Calculator

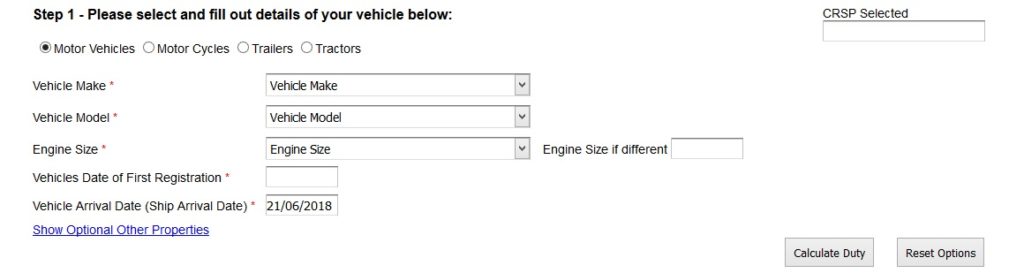

Step 1:

Select if it’s a Motor Vehicles, Motor Cycles, Trailers or Tractors

Select:

- Vehicle Make *

- Vehicle Model *

- Engine Size *

- Enter Vehicles Date of First Registration

- Vehicle Arrival Date (Ship Arrival Date) *

Click Calculate

Step 2:

The duties and taxes payable for importing your vehicle will be generated:

| Details | Values in KES | Description |

| Import Duty @ 25.00% | Import duty payable to KRA | |

| Excise Duty @ 20.00% | Excise duty payable to KRA | |

| VAT @ 16.00% | VAT payable to KRA | |

| IDF @ 2.25% | Input Declaration Fees payable to KRA | |

| Railway Development Levy @ 1.50% | Railway Development Levy payable to KRA | |

| Motor Vehicle Registration Cost | Vehicle Registration Charges | |

| Customs Value | The Customs declared value for this vehicle | |

| Total Estimated Taxes Payable to KRA for Importation: | ||

| (Excludes port charges as well as clearing agent costs. Move to step 3 to fill these) | ||

Step 3:

If you want to know your final cost of importing your vehicle, you ill be required to fill

Vehicle Purchase Price in Foreign Country

Freight Costs to Mombasa (if price does not include this)

Port and Clearing Agent Costs (Not sure? Get a quote)

Miscellaneous Costs

Taxes Payable

The final cost of the car will be generated

Betty is a qualified teacher with a Bachelor of Education (Arts). In addition, she is a registered Certified Public Accountant. She has been teaching and offering part-time accounting services for the last 10 years. She is passionate about education, accounting, writing, and traveling.